DOJ v. Google: Case outline & arguments analysis

The DOJ is going after specific anti-competitive mechanisms, and the specifics of Google's onerous Android deals might be the smoking gun

This is the first of three articles in Unpacked’s “Tech Policy September” series.

Disclaimer: The views expressed in this article are solely my own and do not reflect the views or positions of any organization with which I am affiliated, including my employer.

On Tuesday this week, the US Department of Justice (DOJ) and Google both made their opening arguments in what is the first anti-trust trial in 25 years. Though regulating Big Tech has been a big part of public discourse lately, no cases have gone to trial. The last public trial was DOJ v. Microsoft in 1998, where the court ruled that Microsoft did indeed abuse its monopoly position to suppress competition in the browser market.

Since then, no regulatory agency (FTC or DOJ) has successfully won a major anti-trust case against Big Tech. There’s two things I love about this trial:

If the DOJ wins, it will be a HUGE win for them and lay out a much-needed precedent for regulating Big Tech

Recently, I have been jaded about US regulators’ ability to reign in Big Tech, particularly the FTC that has had multiple missteps; but the DOJ’s suit is very well-drafted, focused and targets specific anti-competitive mechanisms, and I walk away deeply optimistic at the end of this analysis

There is a ton of news coverage on the topic but it lacks nuance, so for the sake of this article, I will primarily refer to the original source (DOJ’s 58-page complaint against Google). Let’s dive into a few things systematically:

Anti-trust and the consumer welfare standard

Outline of DOJ’s case against Google

Analysis of DOJ’s arguments

What lies ahead

Anti-trust and the consumer welfare standard

We have talked about this previously but I’ll recap the history of anti-trust one more time as we understand DOJ v. Google (deeper history if you want to geek out):

In 1900s, massive conglomerates (“trusts”) came into existence and the balance of public-private power shifted to these companies

In response, the Sherman Act of 1890 was passed to add checks on private power and preserve competition; This law was used to litigate and break down “trusts” that were engaged in anti-competitive practices (predatory pricing, cartel deals, distribution monopoly)

The law was foundational to breaking up Standard Oil in 1911, one of the oldest and fairly egregious monopolies in modern history

Around 1960s, judges faced a lot of backlash for judging based on spirit of the law instead of letter of the law; for example, interpreting the Sherman law to determine if a set of companies “unreasonably restrain trade” involved subjectivity and judges were accused of engaging in judicial activism

To introduce objectivity, around the 1990s, the Chicago School pioneered the consumer welfare standard, under which an act is deemed anticompetitive “only when it harms both allocative efficiency and raises the prices of goods above competitive levels or diminishes their quality”

This continues to be the standard today. The problem is: what happens when the product is offered to consumers for free? This is true for a wide range of apps / digital products today, from search to social media to content / streaming platforms, and by extension - Google. In fact, Judge Mehta who is presiding over DOJ v. Google specifically asked this question during opening arguments.

This is one of the biggest reasons why this case is not straightforward. The consumer welfare standard was useful in days where higher prices were the most common mechanism of consumer harm but in the post-Internet era, the consumer welfare standard is a very narrow interpretation of the anti-trust law.

Luckily, there is some tech precedent, which the DOJ calls out in their suit. DOJ v. Microsoft in 1988 was ruled in DOJ’s favor - Microsoft’s anti-competitive mechanism of locking in distribution for browsers through their control of the Operating Systems market was ruled unlawful. This however has not been tested with Big Tech, and DOJ v. Google will therefore set a really important precedent. With that context, let’s go into the outline of this case.

Outline of DOJ’s case against Google

Broadly, the outline of DOJ’s arguments looks something like this:

Google is a monopoly in three markets - general search, search

advertising, and general search text advertising

Google unlawfully uses its monopoly position to not let any rivals succeed

The primary anti-competitive mechanism used by Google is exclusionary agreements with distributors (device manufacturers, wireless carriers)

Through these exclusionary agreements, over the span of decade, Google dominated a majority of entry points for search, and therefore made it impossible for any new search engine to emerge

By choking up distribution channels, Google has also closed the possibility of any new search engine getting scale, which is an essential component of what makes a search engine good (eg. through feedback on search relevance / quality)

By monopolizing Search, Google has also monopolized search advertising, and uses monopoly profits to further lock up distribution by paying distribution partners

This is a fairly robust set of arguments (we will dig deeper shortly). Note some of the nuances around the argument.

First, the DOJ argues that Google is a monopoly. To do that, Google explicitly lists three markets where they argue that Google is a monopoly.

Second, they make the argument that Google engaged in anti-competitive means to gain and maintain their monopolistic position. Note here that it is not illegal in the US to be a monopoly. It is only illegal to use unlawful means to maintain monopoly position, and therefore, the onus is on the DOJ to prove that Google engaged in anti-competitive mechanisms. To do this, DOJ dives deep into distribution agreements and lays out (in a lot of detail) why Google behaved anti-competitively.

Third, the DOJ makes the arguments that Google’s behavior caused competitive harm, and eventually harm to consumers and advertisers. They go into a fair bit of nuance about what stops new search engines from succeeding (lack of distribution because of Google choking up all entry points, and consequently the lack of ability for rivals to scale). They make some arguments around how this has / will cause consumer and advertiser harm, which I generally believe are true but the arguments around both of these are fairly subjective.

While it is important for the DOJ to prove that Google is a monopoly (#1) and that their monopolistic position has caused harm (#3), I think the crux of the trial is going to be about the DOJ proving that Google engaged in anti-competitive mechanisms (#2), and I believe they have a strong case.

Analysis of DOJ’s arguments

DOJ argument #1: Google is a monopoly

Any anti-trust action requires the regulator to establish markets under consideration, and the DOJ lists out three - general search, search advertising, and general search text advertising.

In the general search market, DOJ argues that Google is a monopoly. They argue that this is a relevant market because it is uniquely characterized by services that provide “one-stop shop” access to an extremely large and diverse volume of information across the internet. Other players in this market include Microsoft Bing, Yahoo and DuckDuckGo.

Google makes the argument that this is not the right market, and that it’s part of a much bigger market that includes everyone searching for everything. This would include someone searching for products directly on Amazon, music on Spotify, videos on TikTok, or answers on Reddit.

While there is some truth to it (consumers do search often on Amazon directly, TikTok is increasingly used for search by younger consumers, and consumers search Reddit for specific things), I think Google is running out of steam with this argument. It’s a reasonable argument for a much smaller company that is owning a much smaller market, but when you own 90%+ of $160B-$220B market in an era where there is consensus around reigning in Big Tech, I’m skeptical this argument holds up.

The second market is search advertising, which the DOJ argues is unique because the ads are shown directly in the context of a user’s specific query, unlike social media or display ads. Google owns the majority of this market. Google is likely to argue that they belong to a larger digital advertising market, where they face rigorous competition from both incumbents like Meta and Amazon, and emerging players like TikTok.

Having worked with advertisers for the past few years, I’m inclined to side with the DOJ on this one. I think markets should be defined from the lens of how customers of these products think about them, and most large advertisers and ad agencies have clear separation between search advertising and non-search advertising budgets.

The third one is a little confusing. DOJ has a carve out for general search text advertising, which is a subset of search advertising that is fully text based (eg. the vertical text-based ad you see on search, rather than image-based product ads). It’s unclear why this carveout exists but my guess is that it’s a tactical backup for the DOJ in case the judge is only willing to make a narrower verdict.

Overall, the fact that the judge let this case go to trial is a big signal that he is willing to accept the DOJ’s argument that Google is a monopoly.

DOJ argument #2: Google’s distribution deals were anti-competitive

To understand the importance of these deals, it’s helpful to look at user entry points for Search. Search typically happens through desktop (computers) and mobile devices:

Desktop is simpler - search happens through a browser, and Google Chrome owns 65% of the market share (followed distantly by Safari, Microsoft Edge, Mozilla Firefox)

Mobile phone market share splits 60% iOS and 40% Android in the US (and flips 30-70 globally), with slightly different search entry points

On iOS, most search happens through a browser, with Safari being the dominant browser

On Android however, there are a broader set of entry points based on how a device manufacturer integrates it (see screenshot below); it’s ~29% Chrome, 23% Google Quick Search Box (“QSB”), and ~26% non-Chrome browsers.

Note that of the above entry points, Google only controlled a subset. This was an okay but not great position for them because every uncontrolled entry point is a threat to Google’s search market share. This is not an unreasonable way to think for any large company and there is nothing illegal about it, so Google pursued deals with a wide range of companies: device manufacturers (Apple, LG, Motorola, Samsung), major wireless carriers (AT&T, T-Mobile, Verizon) and browser developers (Mozilla, Opera, UCWeb). These deals primarily entailed having Google as the default search engine in all of their entry points (browser or otherwise) and Google would pay these companies advertising revenue share in return.

The DOJ argues that these agreements cover ~60% of all search queries in the US, and combined with Google’s own properties (like Chrome, Pixel phones), the coverage is ~80% of all search queries, i.e. Google has essentially locked up distribution for a majority of searches.

You might be thinking: so what? It’s not illegal for a monopoly to exist, and maybe it’s just the free market at play. You’re not wrong - so far, nothing we talked about is unlawful, but the DOJ brings out some damning evidence for why Google’s deal making was monopoly abuse. The devil lies in Android.

Google acquired Android in 2005 in response to their concern that “more individuals are using non-desktop devices to access the internet”. In 2007, Google open sourced Android, i.e. anybody could use this code and make their own version of Android, typically called a “fork”. Device manufacturers hesitantly adopted Android (despite seeing Google as a threat) in the hope that they would have full control over how they use Android, given it’s open source.

Once enough distributors agreed to start using Android, it attracted more app developers to build for Android, and this in turn brought more consumers into Android. This increased distributors’ reliance on Android which they didn’t love, but to make it more palatable to them, Google started sharing advertising and app store revenue with them. This in turn helped lock in the distributors. From 2009 to 2012, Android’s market share of licensable operating systems tripled, and today 95% percent of all licensable mobile operating systems is Android. Note the lock in effect here - if you are launching a new phone today, you basically have no option but to use Android because it’s nearly impossible to build a new mobile app store ecosystem from scratch (Microsoft tried and failed).

The suit articulates Google’s thinking around Android:

Control over Android has always been a critical issue. As Google’s Android team leader asked at the time: “How do we retain control of something we gave away?” Google’s answer is the set of contractual “carrots” and “sticks” that empower Google to “[o]wn the ecosystem” and help thwart any alternative mobile ecosystem from developing that could support a different search provider.

This contractual “carrots” and “sticks” approach was a complex mesh of legalese, through which Google essentially forced the distributors to agree to more and more onerous terms over time, and took control away from them as a means to maintain their search monopoly. This, I think, is DOJ’s smoking gun. Let’s zoom in on the contracts more to see why this is a smoking gun.

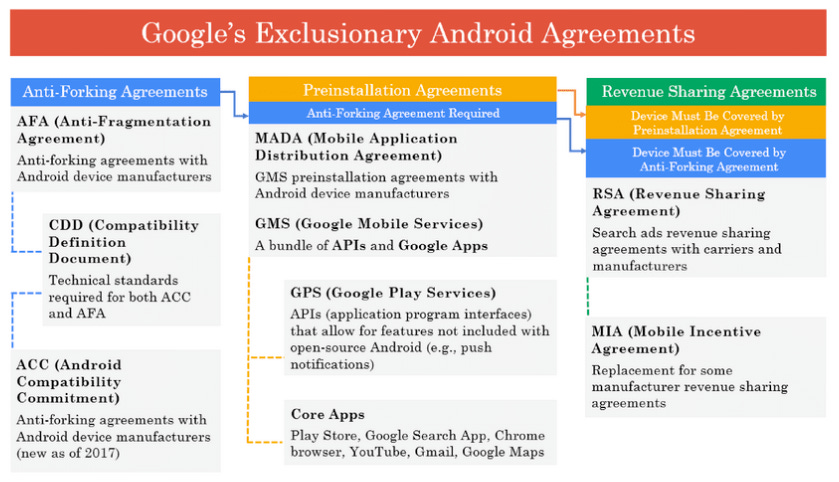

The chart looks overwhelming but it’s not. I’ll try to paraphrase what Google did, and it gets progressively more onerous:

Google signed “anti-forking” agreements with manufacturers, which broadly prohibits manufacturers from taking any actions that may cause “fragmentation” of Android (eg. manufactures cannot create and then license their own versions of Android even through Android is open source)

Then, Google made anti-forking agreements as prerequisite for having pre-installation deals, i.e. if a new device that’s being sold by a manufacturer had to pre-install Google apps like Maps, or use other essential Google APIs, they had to first sign an anti-forking agreement

Over time, Google started including important features into Google’s own set of apps and APIs rather than the open-source code. For example, Google Mobile Services which includes all critical Google apps (like Search, Chrome, YouTube, Maps) and more notably the Play Store, could not be accessed without signing the pre-installation agreement

Google started making the terms more onerous by including essential features (like an app’s ability to send push notifications) into Google Mobile Services, essentially forcing distributors to sign pre-installation agreements to get access to essential services

These pre-installation agreements however, had language that forced distributors to pre-install a full suite of apps identified by Google, including the search access points most frequently used by consumers: Chrome, Google search app, Google search widget, and Google Assistant

And ALL of the above were pre-requisites for revenue sharing agreements

This is classic monopolist behavior. If you’re already convinced, great. If you’re not, let me try this again.

Imagine you are Motorola or Xiaomi. Despite you being a large device manufacturer, you have no choice but to use Android because you have been using it for a while - the switching costs are really high, and even if you take the plunge, it would take you forever to build an app store ecosystem. Also note that selling mobile devices (except Apple) is a low margin business, so any incremental dollars have a large impact on your bottom line.

Now you are essentially forced to pre-install all of Google’s suite of apps (Google Search, Chrome, Search widget, Assistant) even if you don’t want to, because if you refuse, you lose access to essential services including the app store. You could be taking money from Microsoft Bing to pre-install their app on your devices and set them as your default search engine but you can’t, because if you do, you lose access to essential Android services.

This falls squarely in the area of “tie-in sales” and “exclusive dealing” which are fairly established anti-competitive practices. While this might not meet the consumer welfare standard, in my opinion this gets fairly close to what Microsoft was doing with Netscape (with some differences), and there is reasonable precedent for this being anti-competitive. And this, I think, is DOJ’s smoking gun that helps them win against Google Google.

Side note: The size of Google’s deal with Apple is large for sure and raises eyebrows, but it’s unclear to me how unlawful or anti-competitive it is.

DOJ argument #3: Google’s monopoly caused competitive harm, and eventually harm to consumers and advertisers

This is a somewhat complicated argument to make in a market with free products, because in essence, the DOJ is arguing a counterfactual. That if there had been more competition, consumers and advertisers would have been better off.

It’s difficult to argue with data because it’s a counterfactual but the DOJ makes a reasonably robust subjective argument:

Google used monopoly profits to lock in distributors with revenue sharing, thereby making it impossible for a new entrant to get access to any search entry point; this in turn limited the scale that the new entrant has, thereby limiting the data they have access to, and consequently reinforcing Google’s dominance as a superior product

In other words, Google’s dominance, which resulted from anti-competitive practices (discussed above), killed innovation and the possibility of new products in the market

Restricting competition harmed consumers by reducing the quality of search services; while Google continues to be the superior product, DOJ makes the counterfactual argument that there could have been more innovation / better consumer value if new products were allowed to come up

The more convincing argument for consumer harm is the state of privacy today when users have to give up all personal data to get access to Google products; this would have played out differently if other privacy-focused browsers like DuckDuckGo and Neeva were allowed to succeed

DOJ also argues that lack of competition is harming advertisers; again, the counterfactual is a subjective argument that advertisers could have benefitted from more competition in the search advertising market, both from lower prices and a better product

The more convincing argument is that advertisers have had to give up more and more control and negotiating power to Google - today, if you are not a massive advertiser, you have no negotiating power with Google and you essentially have to agree to whatever online terms are offered to you. Google also continues to take over more and more control, including adding more powerful features (eg. data modeling for ads measurement) behind black boxes and closing down the walls of the Chrome ads ecosystem, using privacy changes as cloud cover

While Google continues to double down on the “we are a superior product and that’s why we won” narrative, I think it’s going to become more and more challenging for them to defend against the fairly robust arguments that the DOJ has laid out.

What lies ahead

I won’t go in much detail here but this is a long process. The trial is ten weeks long and it includes a side show we didn’t talk about (several state AGs will argue an additional claim that Google abused their monopoly power in advertising to self-preference their own search engine).

At the end of the trial, there will be a ruling by Judge Mehta on each of the three counts of monopoly abuse DOJ is alleging (in three separate markets). I’m not a legal expert but based on the robustness of DOJ’s arguments around the anti-competitive Android deals, I’m inclined to think the DOJ might win at least partially. If the DOJ wins, there will also be a ruling on what the remedies for Google’s actions are, and Google will have the option to appeal the decision (as did Microsoft when it lost).

If the DOJ loses however, I think that will be a major wake up call for legislators that the current anti-trust laws are insufficient to deal with Big Tech, and legislative action is needed urgently.